Tax Season 2026 Is Coming is here!

With Tax Season 2026 around the corner, Molimar Tax Consulting Service wants to help answer the most common tax questions we hear from our community. Every year, many clients tell us things like:

- “I have an ITIN, my kids have Social Security numbers, and why do I still have to pay taxes?”

- “I work a 1099 and my friend at work got a refund but I owe!”

- “I thought having kids meant money back?!”

If this sounds like you, you are not alone. This is one of the most common and confusing tax situations, and it does not mean you did anything wrong.

Let’s explain it simply.

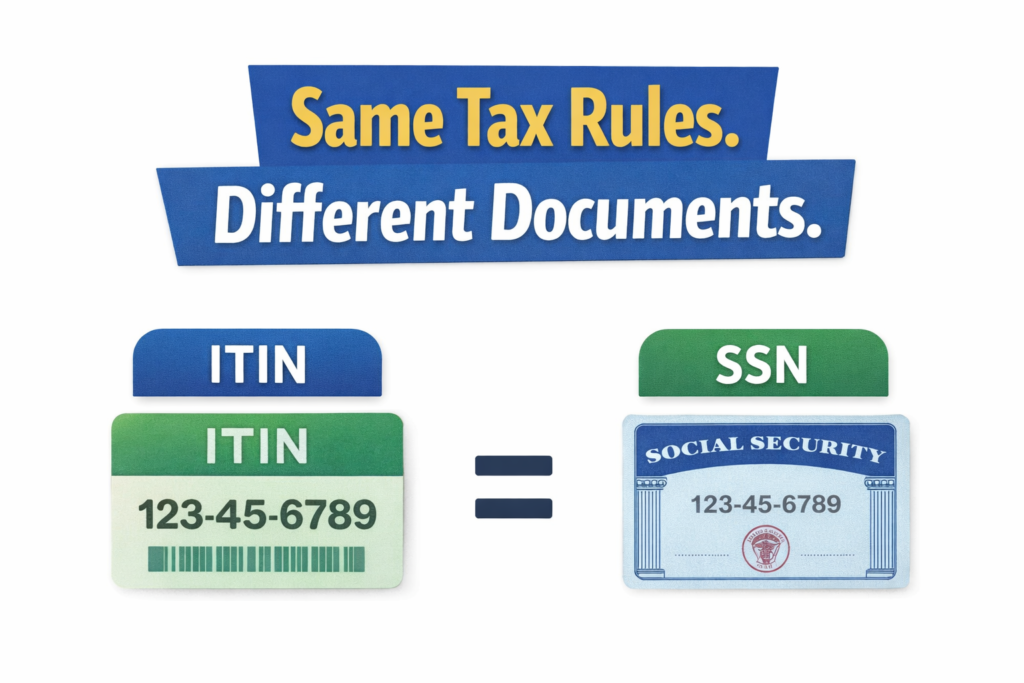

ITIN vs. Social Security Number: What Really Matters

Having an ITIN instead of a Social Security number does NOT automatically mean you pay more taxes.

The IRS:

- Uses the same tax rules to calculate taxes

- Does not charge higher taxes because of immigration status

Most of the time, the difference is how you are paid, not whether you have an ITIN or a Social Security number.

1099 Jobs vs. W-2 Jobs: The Biggest Reason People Owe…

This is the number one reason people are surprised at tax time.

If you work a W-2 job:

- Your employer takes taxes out of every paycheck

- You don’t see that money because it’s already paid

- At tax time, you may get a refund

If you work a 1099 job:

- No taxes are taken out during the year

- You receive the full amount of your pay

- Taxes are due later, when you file

Simple Example:

Person A (W-2):

- Earns $30,000

- Taxes taken out all year

- May get a refund

Person B (1099):

- Earns $30,000

- No taxes taken out

- May owe at tax time

Same income. Different result.

Having Kids Helps — But It Does Not Erase All Taxes

Children can help reduce taxes, but they do not always eliminate them.

Important things to know:

- Some credits reduce the tax bill

- Some credits can give refunds

- Some credits depend on income and job type

If you work 1099, you still owe self-employment tax, even if you have children.

That’s why someone with kids can still owe taxes.

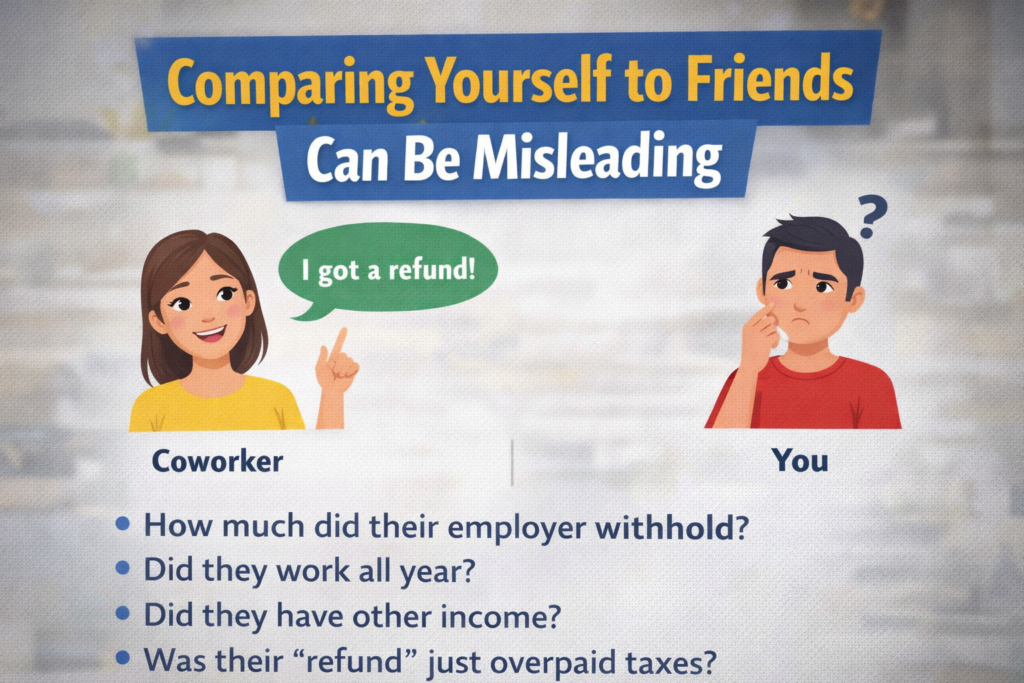

Comparing Yourself to Friends Can Be Misleading

We hear this all the time:

“My coworker got a refund.”

What you usually don’t see:

- How much tax their employer already withheld

- Whether they worked the full year or part of the year

- If they had other income

- If their “refund” was simply money they overpaid

A refund does not mean someone paid less tax.….It usually means they paid too much during the year.

Even W-2 Workers Can Owe Taxes

This surprises many people, but it’s true.

If not enough tax was withheld:

- W-2 workers can still owe

- This is common

- It does not mean anyone did something wrong

Bottom Line

Two people can:

- Work hard

- Have kids

- Earn similar income

…and still get very different tax results.

The difference is usually:

- How the income was earned

- When taxes were paid

- Not immigration status

- Not because the tax preparer didn’t try

Our job as tax professionals is to use the law to reduce taxes as much as legally possible, not to promise refunds the law does not allow.

What’s Next?

In our next post, we’ll explain 1099 vs. W-2 income in more detail and share tips on how to avoid tax surprises next yea

Need Help With Your Taxes?

If this sounds like your situation, we’re here to help.

Molimar Tax Consulting Service

7411 Riggs Rd, Suite 218

Hyattsville, MD 20783

301-434-5677

molimartaxservice.com

Trabajando para nuestra gente.

Walk-ins are welcomed! Let’s take the confusion out of tax season—together.

Leave a Reply

You must be logged in to post a comment.